CHRIST University offers rigorous programs, valuable resources, and countless opportunities that will enable you to pursue your desired course of study..

BCom (Financial Analytics/Honours/Honours with Research), MSc (Global Finance & Analytics), PhD in Commerce

Explore

Courses Offered: MA (English with Digital Humanities) & Doctor of Philosophy (PhD) in English

Explore

BA LLB, BBA LLB, LLM (Corporate & Commercial Law), LLM(Constitutional & Administrative Law) & PhD in Law.

Explore

BSc(Computer Science, Data Science), BSc(Economics, Statistics), BCA, MSc(Data Science), MSc (DS, CU)+MS (System Science) (BU) USA&l...

Explore

on your publication in a Q1 journal: Utilities Policy titled

"Developing a global sustainable electricity use index using the pressure-state-response framework"

for successfully presenting the paper titled “Fragmented Selves and Digital Memory: Autofiction in the Age of Social Media” at the Sixth Biennial IABA Chapter of The Americas Conference

Badminton Women's team (Khushi Jha & Soujanya S Pillai) have secured 2nd place at Badminton Super Cup hosted by Flame University, Pune on 9th march 2025

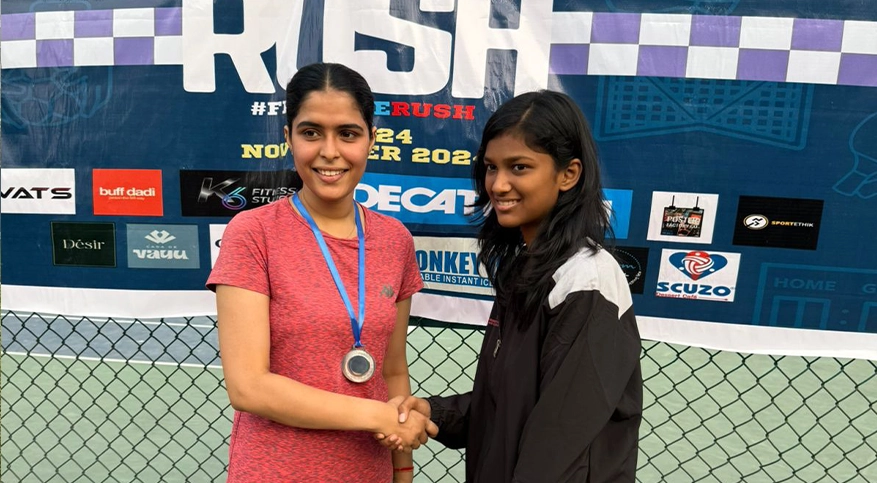

Our students, Ritika Singh has secured Second Place for Lawn Tennis Women Singles in the prestigious RUSH tournament conducted by Symbiosis University, Pune

Football Women's team have secured 2nd place at GH Raisoni College, Engineering and Management, Pune on 5th march 2025

We are proud to announce that a First-Year MAEDH student has successfully qualified for NET!

CHRIST (Deemed to be university) Among 1253 Universities from 87 countries and 4866 Proposals

Christ University Wins Excellence in Tech-Enhanced Training and Placement Award at TechEDU India Awards 2025.

CHRIST (Deemed to be University) Awarded ‘Outstanding Private Deemed to be University’ at The Economic Times Education Excellence Awards 2025

Where borders fade and learning travels.

Ideas don’t need passports. Through vibrant international collaborations, exchange programs, and cross-cultural experiences, this space turns the world into a shared classroom. It's not just about going global — it's about growing global, together.

Christ University hosts distinguished guests from academia, industry, and the arts, inspiring students and faculty through insightful interactions and discussions.

Data Analytics, AI, ML, and Trading Trainer, Pune

Founder & CEO - PFA Academy

Visiting Faculty - NSE, NSE Academy,

NSDL, NISM & IIM

Provost

Samarkand International University of Technology at Samarkand

Dean Faculty of Economics, Vietnam

Vice President Academic Affairs

Executive Director and Campus Dean

Professor,

Western Michigan University

Mayor at City of Plainview, Texas USA

Director

Grant Thornton, Haryana

Director

Wheaton Advisors, Pune

Partner

Deloitte, Bangalore

Vice President

Credit Suisse (now UBS), Pune

Certified Scrum Master and Project Manager,

Ernst & Young LLP,Mumbai

Director & CEO

Excess Edge Experts Consulting

Partner of Fox Mandal

Former Chief Justice of Rajasthan & Tripura High Court

Senior Advocate,

Supreme Court of India

Indian Film Actor

Former Vice Chancellor,

MG University

Former Judge,

Bombay High Court

Senior IAS officer,

Principal Secretary Govt. of Kerala

High Court Judge of Patna

Corporate Sales Manager

American Express, APAC Region

Bengaluru

Credit Risk Associate

JP Morgan Chase

Bengaluru

Reliability Engineer

ServiceNow

Dublin, County Dublin, Ireland

Finance Associate

Wells Fargo

Chennai

Risk Engineering Operations Analyst

Swiss Re,

Bengaluru

Business Operations Analyst and AI SME

IndiGo (InterGlobe Aviation Ltd)

Airlines and Aviation Gurgaon, Haryana

Management Trainee

Malabar Gold and Diamonds

Hyderabad

_20250713062253..png)

Relationship Manager

Tata Capital

Hyderabad

Senior Account Executive

Paperflite

Chennai

Marketing & PR Trainee

Reliance brands limited

Mumbai, Maharashtra

Sales and Marketing Director

Shree Ganesh Bearing Machinery Stores

Chennai

_20250713065540..png)

Tax Associate

PwC Acceleration Centers

Bengaluru

Data Analytics Apprentice

Google

Gurugram, Haryana

Data Analytics Apprentice

Google

Hyderabad

Socialize

with wide Numbers